In a context where sustainability and recycling of plastics are at the heart of environmental concerns, Eastman’s decision to question its chemical recycling plant project in Normandy raises significant worries. Estimated at 1 billion euros, this ambitious project, which aimed to become one of the largest facilities of its kind in the world, may well fall through. Despite notable advances in acquiring land and securing contracts for the supply of plastic waste, regulatory uncertainties within the EU cast a shadow over the project’s future. Debates over new directives concerning recycling are intensifying, highlighting issues of unfair competition against imports of recycled plastics from regions with less stringent standards. As the ecological transition is more relevant than ever, the threat of Eastman pulling out could have significant repercussions on both the recycling industry in Europe and the European Union’s ambitions regarding sustainable development.

Table des matières

ToggleEastman: A Chemical Recycling Plant in Normandy Facing Uncertainty

Eastman’s ambitious project, valued at 1 billion euros, aimed at establishing a chemical recycling plant in Saint-Jean-de-Folleville, Normandy, is experiencing increasing uncertainties. While the company seems poised to make significant progress in the field of plastic waste recovery, several factors threaten its realization. In this article, we will thoroughly examine the reasons why Eastman might abandon its project and what implications this would have for the recycling industry in Europe.

Project Status: A Mixed Report

As of the end of November, Eastman reported encouraging indicators regarding its Normandy project. Indeed, the company has secured 70% of contracts for the supply of plastic waste, guaranteeing volumes over periods ranging from 3 to 9 years. Moreover, the building, operation, and environmental permits have been obtained, placing the firm in a favorable position to commence construction.

However, a major fact complicates this dynamic. Eastman’s CEO in France emphasized that the final investment decision would not be taken until customer commitments for minimum volumes are assured. This lack of security regarding sales contracts, particularly due to ongoing discussions about European regulations, casts a shadow over the project’s viability.

The digitization of industrial processes and the adoption of cloud solutions could play a pivotal role in optimizing operations, but the need for clear regulation remains essential to attract investments in similar projects. A case study to follow is that of Loop Industries, which recently decided to abandon its project in Moselle, further reinforcing concerns about the future of recycling in Europe.

Impact of European Regulations on Plastic Recycling

The recycling sector is particularly subject to government regulations, and the current uncertainty within the European Union could seriously compromise Eastman’s projects. Proposed regulatory changes, especially regarding the incorporation of imported recycled plastics, could indeed disrupt market competition. According to Eric Dehouck, a major point of contention lies in the fact that the EU is preparing to relax rules regarding the importation of recycled plastics from external markets, where treatment and reintegration criteria are not the same.

Such a decision could lead to a scenario where imported recycled raw materials are cheaper than those of European origin, thus preventing a return on investment for projects like Eastman’s. According to a recent study, up to 50% of companies in Europe might constrain their recycling activities because of this dynamic. Recycling companies could consider other markets, jeopardizing the revitalization of the circular economy in Europe.

Moreover, this orientation can be described as economically and ecologically nonsensical, according to several industry experts. Additionally, it could create an environment where imported plastics, less environmentally friendly, continue to enter the market while undermining efforts to improve recyclability within the EU. The situation demands concrete recommendations: industry stakeholders must advocate for a common policy and high standards that promote local recycling over imports.

Potential Economic and Environmental Consequences

The potential cancellation of the Eastman project raises broader concerns. According to recent reports, the chemical recycling plant in Normandy could have become a showcase for innovation in plastic waste transformation. Moreover, this project would have contributed to creating several jobs in the region, as well as achieving long-term sustainability goals.

Statistics show a skyrocketing of production costs, especially in the energy sector. Eastman recently revealed that cost increases, particularly due to inflation, have pushed the budget projection beyond 1 billion euros. This creates tensions on profit margins and prompts Eastman to reconsider its expansion plans in France.

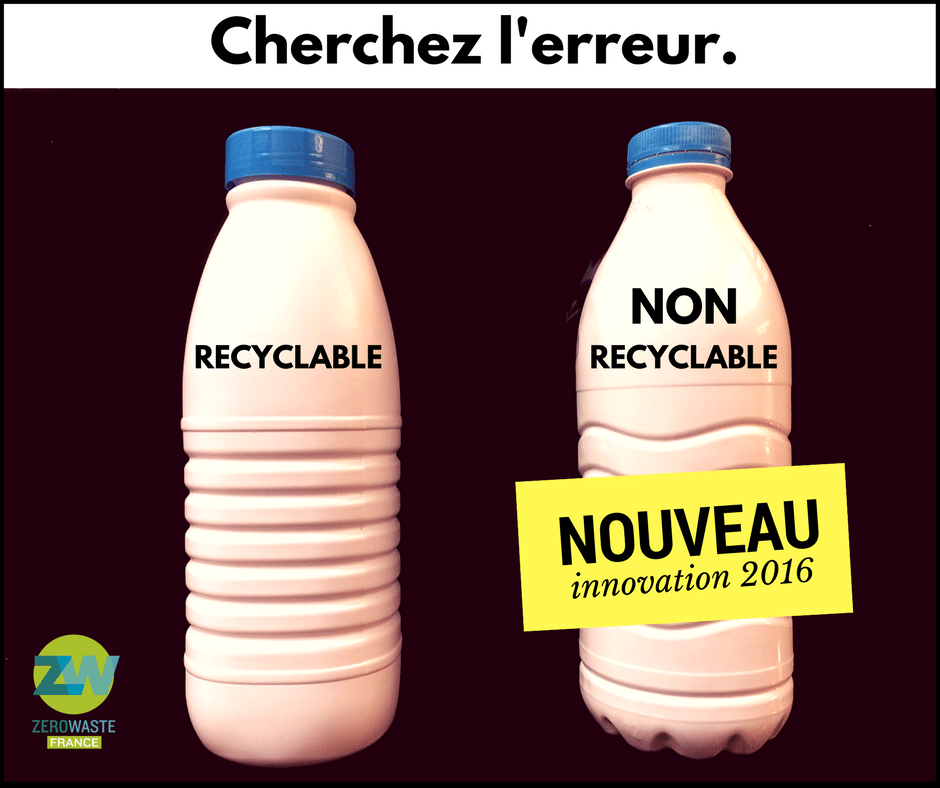

While other companies such as Syproval are launching innovative initiatives for recycling non-recyclable waste, the need for a harmonized approach and collaboration among various actors in the recycling industry becomes increasingly pressing. Projects like that of Constellium, which seeks to position itself in the green hydrogen niche in recycled aluminum production, serve as examples for Eastman in its strategic reflection.

The potential decline in the recycling sector due to regulatory pressures could also impact waste management policies at the European level, thereby undermining overall sustainability goals. Market players in the EU must not only adapt to these beneficial initiatives but also adopt a constant innovation approach to integrate technological improvements for recycling.

In summary, if Eastman were to abandon its project in Normandy, the implications would far exceed mere business considerations. The recycling industry, already under pressure, would face multiplied challenges in terms of environment and economy.

FAQ on the Eastman Project in Normandy

What is the main reason Eastman might abandon its plant project? The decision to abandon the project depends on securing customer commitments for minimum volumes of recycled plastics.

What is the current status of the project in Normandy? The project is on schedule, with 70% of contracts secured for the supply of plastic waste and building permits obtained.

What issues are recycling projects in Europe facing? European indecision regarding regulations related to reuse and incorporation of recycled plastic into products creates uncertainty for market actors.

What impact would imports of recycled plastics from outside the EU have? Allowing imports of recycled plastics could create an unbalanced competitive environment and threaten the recycling economy in Europe.

How does European regulation influence recycling projects? Brands are awaiting clarifications on European regulation before committing to integrating recycled materials into their products.

What is the response of industry players to these uncertainties? Many recycling projects are being postponed or canceled due to changes in market conditions.

What concerns are there regarding the costs of the Eastman plant? Eastman has acknowledged cost increases due to inflation and energy prices, which could affect the initial budget planned for the project.

What is the total investment planned for the Eastman project? The investment for the project is now expected to exceed 1 billion euros.

Why did Eastman choose France for this project? Eastman chose France due to access to competitive and decarbonized electricity.

“`