HTML:

“`html

The market for air-water heat pumps is currently experiencing a significant downturn. After a strong growth year in 2022, sales fell by 4.7% in 2023. Projections targeting one million units produced and sold annually by 2030 seem increasingly out of reach. This situation is exacerbated by significant declines, with a 40% drop since September 2023. The goal of producing one million heat pumps by 2027 is struggling to materialize, highlighting the major challenges facing the sector.

The market for air-water heat pumps is experiencing a significant decline after a decade of growth, calling into question the ambitious goal of producing one million units by 2027. In this article, we will examine recent statistics, the factors contributing to this slowdown, and the challenges that need to be overcome to revive this crucial sector in the energy transition.

Table des matières

ToggleA marked slowdown after a year of strong growth

After a strong growth year in 2022, the market for air-water heat pumps has significantly slowed down. This promising segment is now seeing a decline of -4.7% at the end of 2023. Even more concerning, sales have dropped by 14%, from 351,970 units in 2022 to 302,030 in 2023.

The different facets of the decline

A cold snap for air/water heat pumps

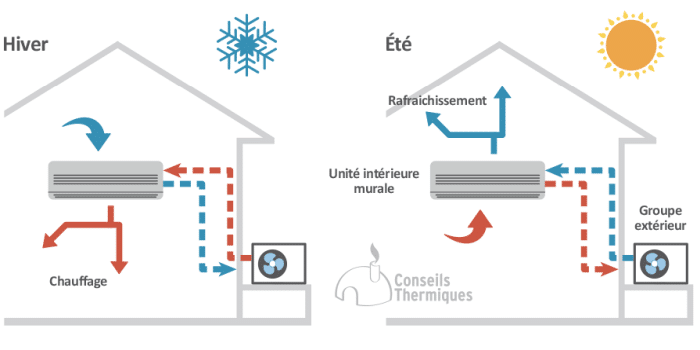

It is important to note that this trend is not isolated to just air-water heat pumps. Air-air heat pumps are also showing signs of weakness with a decline of -17% in the last quarter of 2023, -3% in January 2024, and -12% in February. This general market downturn for heat pumps reverses a decade of continuous growth and questions the popularity of these energy solutions.

Sales plummeting since September 2023

The trend observed since September 2023 is particularly concerning. A 40% drop in sales of air-water heat pumps has been recorded, reflecting a more than gloomy economic climate. The annual growth prospects of 10% by 2027 seem increasingly difficult to achieve.

The government’s ambitious targets at risk

The government aims for a gradual replacement of oil and gas boilers in favor of heat pumps, with the ambitious goal of producing one million units per year by 2027. However, the current market situation greatly complicates the realization of this plan, which now seems increasingly distant.

Factors contributing to the market decline

Several factors are at the root of this decline. First, the poor economic climate plays an important role. Current inflation and economic uncertainties are slowing down household and business investments in these technologies. Furthermore, despite available subsidies, the initial installation cost remains a barrier for many individuals.

Temporary nature of subsidies

Subsidies, while generous for air/water models, have not been enough to stem the decline in sales. These aids, often perceived as temporary or insufficient, fail to offset the high initial costs associated with installing these systems. A more sustainable and coherent subsidy strategy may be necessary to revive the market.

Action plan to revive the market

In response to this concerning situation, an action plan has been developed to attempt to produce one million heat pumps by 2027. This plan aims to reduce dependency on fossil fuels and promote more sustainable energy sources. Initiatives such as increasing local production, with companies like Saunier-Duval planning to manufacture 160,000 heat pumps in Nantes within two years, are key elements of this plan.

Provisional conclusion: challenges ahead

The development of the heat pump market looks fraught with challenges, with marked declines in sales and increasingly distant national production goals. It is essential to understand and address the factors contributing to this decline in order to achieve the long-awaited energy transition. Strategic, financial, and economic adjustments will be crucial to reviving this vital sector.

Pompes à chaleur : le gouvernement veut réserver ses aides au « Made in Europe » https://t.co/U6w8eYR36T

— Les Echos (@LesEchos) April 15, 2024

“`