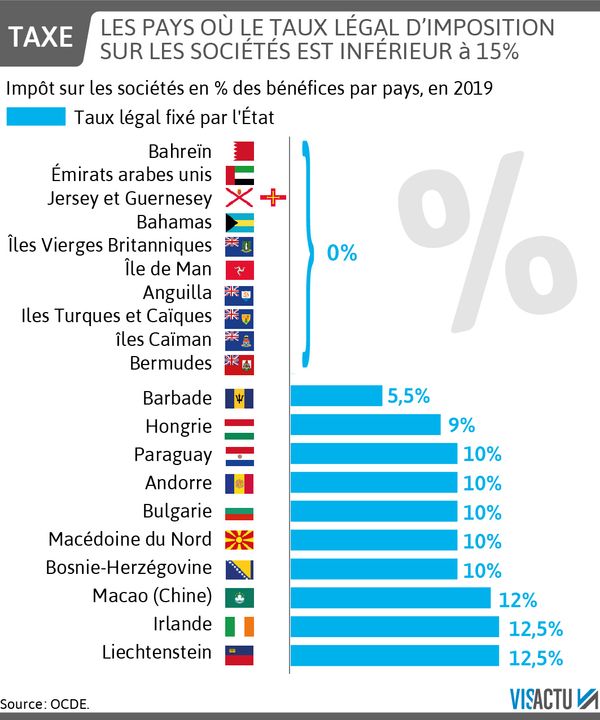

On the horizon of 2023, a notable change is occurring on the global fiscal chessboard, where the trend of decreasing corporate tax rates begins to reverse. Facing significant economic challenges and the gradual arrival of the global minimum tax, several nations in the OECD are revisiting their tax policies. While the average rate rose from 20% in 2022 to 21.1% in 2023, this shift marks a break from the trend of the last two decades, during which a continuous decline prevailed. Like the United Arab Emirates, which introduced their first profit tax, some countries are making strategic decisions to align with this wind of change. This phenomenon is also accompanied by a reorientation of financial strategies, with an increasing emphasis on tax credits, particularly in the area of research and green technologies.

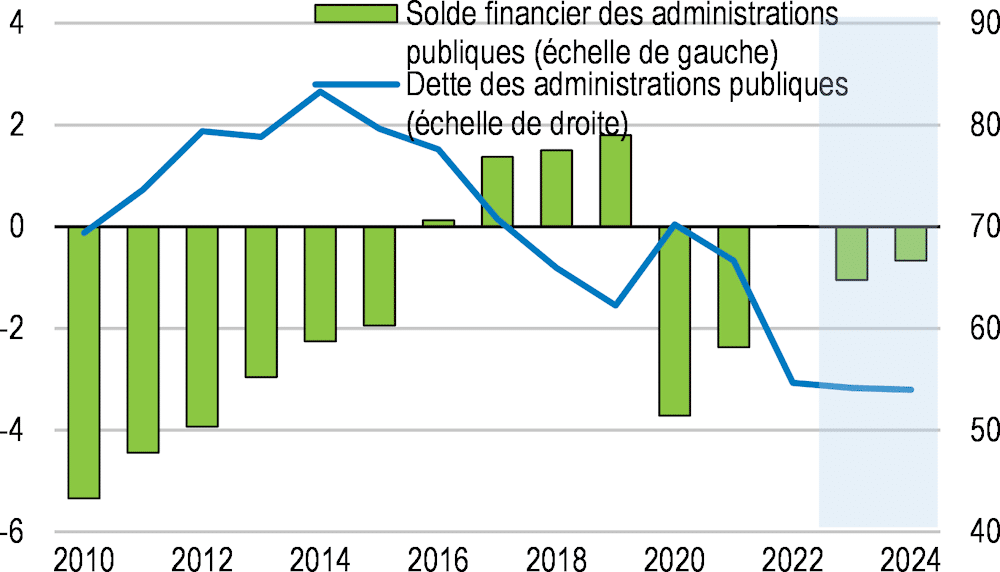

In 2023, the corporate tax (CT) sees its average rate rise to 21.1%, after reaching 20% in 2022, according to the OECD. This increase marks the end of a constant downward trend observed since 2000, when the rate was 28.2%. In 2023, six countries decided to raise their CT rates, partly due to the gradual introduction of the global minimum tax. Among them, the United Arab Emirates established their first profit tax.

The strategies of tax competition are now oriented towards tax bases. Since 2000, the number of countries with tax credits for research has increased from 10 to 33. Investments in green technologies are also gaining popularity with new tax credits adopted by France, Malaysia, Canada, and Japan in 2023.

Table des matières

Toggleconsequences of the increase in corporate tax

With the recent increase in corporate tax rates, substantial implications for businesses across OECD countries can be anticipated. According to a recent report from the OECD, the average tax rate progressed from 20% in 2022 to 21.1% in 2023. This trend reverses a decade of tax reduction and suggests a more rigorous approach to profit taxation. The change is emphasized by the introduction of the global minimum tax by several nations, including the United Arab Emirates, which first applied a profit tax in June 2023 (source).

The impact of this increase in corporate tax is likely to manifest as a brake on investment and competitiveness for businesses. Industries seeking to innovate may find it difficult to allocate funds for research and development if a larger share of their profits is taken by governments. This tax hike encourages companies to reconsider their financial strategy, particularly regarding their geographic location, with a possible return to strategies aimed at exploiting tax differences between nations. As a result, entities are seeking to maintain favorable profitability despite these new tax constraints.

government strategies in response to the increase

Governments in OECD countries are adopting diverse strategies to offset the potentially negative effects of the increase in corporate tax. According to the OECD, specific tax credits for research and development have become increasingly popular. Since 2000, the number of countries offering research tax credits has increased from 10 to 33. Moreover, investment in green technologies also benefits from new incentive tax measures, with notable initiatives in France, Malaysia, Canada, and Japan in 2023 (source).

future perspectives for OECD countries

As OECD countries navigate this new fiscal landscape, it becomes crucial to monitor global economic trends. With the gradual adoption of the global minimum tax, it is conceivable that tax disparities between countries may diminish. This could lead to a more harmonized competitive environment, but also increased pressure to diversify tax strategies and attract investments in innovative and sustainable sectors (source).