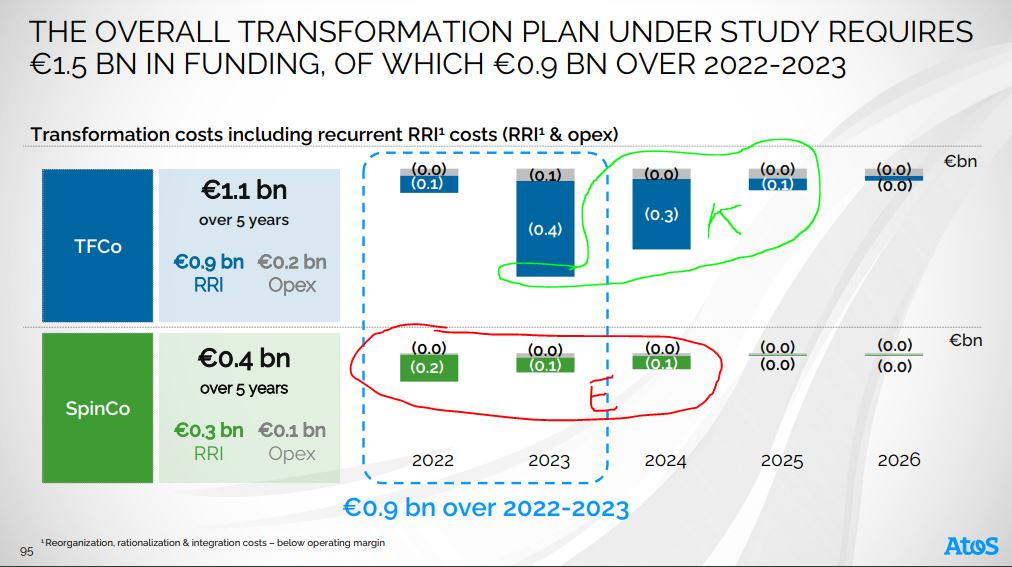

In a decisive turn, Atos sees its safeguard plan validated, initiating a major strategic change. After a period marked by economic turbulence, with debt nearing five billion euros, the company is embarking on a profound transformation to ensure its sustainability. The plan, which includes a capital increase and a debt restructuring, paves the way for a revitalization of its business strategy, aiming to regain a sustained growth dynamic and strengthen its positions in a constantly evolving market. The approval by shareholders and creditors symbolizes a new chapter, mobilizing all resources to overcome persistent challenges.

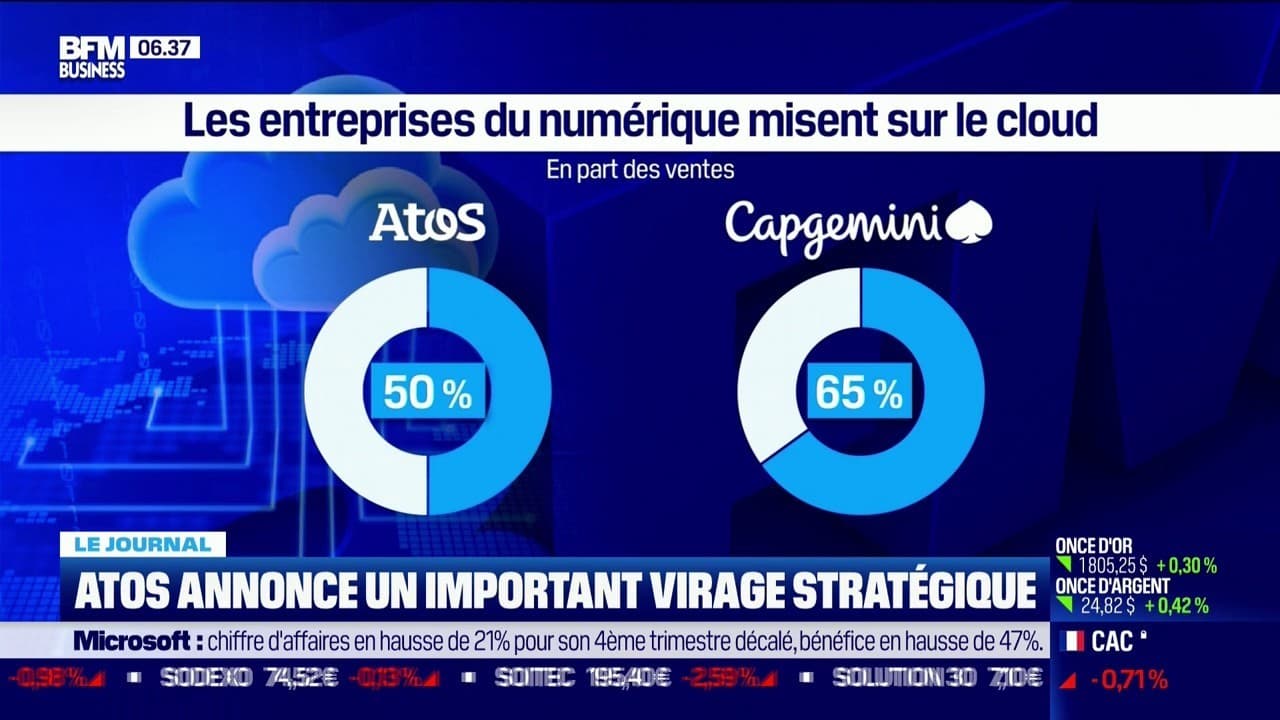

The former star of French technology, Atos, is undergoing renewal with the approval of its safeguard plan. After months of financial uncertainty, this plan, supported by a takeover of creditors and banks, will allow the company to reorganize and reduce its debt by approximately 3 billion euros. Meanwhile, a capital increase of 233 million euros is planned to strengthen equity. Atos is now focused on revitalizing its business strategy, as many non-renewed departures have already weakened the workforce. There are many stakes, notably the need to improve the level of activity and secure new orders, in a context where the market is experiencing some slowdown, even for dynamic players like Sopra Steria and Capgemini.

Table des matières

Toggleapproved safeguard plan

The recent safeguard plan of Atos has been validated by its creditors and shareholders, thus paving the way for a radical transformation. With this plan, the company hopes to rectify a delicate financial situation, marked by a gross debt of several billion euros. By effectively restructuring its debt, Atos aims to clean up its finances to focus on returning to growth and strengthening its competitiveness in the global technology market. More details are available on the official Atos website.

operational and strategic consequences

Despite this glimmer of hope linked to the safeguard plan, Atos is aware of the challenges that lie ahead in terms of operational restructuring. The company is already observing a reduction in workforce with a decline of 10.3% in its employees recorded at the end of September 2024. This situation could complicate Atos’s ability to fulfill its contracts within its Tech Foundations division, which specializes in managed services. The recovery of activity, essential for restoring client confidence, requires a significant improvement in order intake.

financial restructuring and strategic sale

One of the complex angles of Atos’s transformation lies in the strategic choices related to the sale of assets. The recent divestiture of the Worldgrid division to Alten has been finalized, altering Atos’s business base. Furthermore, discussions are ongoing with the state regarding the potential sale of high-performance computing and cybersecurity activities, which are critical segments for the company. The success of these transactions will determine Atos’s ability to achieve sustainable financial balance. Jean-Pierre Mustier, at the helm during this transition, states that the conclusion of these operations is expected by the end of the year, thus laying the groundwork for the anticipated improvement starting in 2025.

Les salariés du groupe Michelin renouvellent leur engagement pour sauvegarder leur patrimoine de proximité ! Nous sommes fiers de vous annoncer les 16 lauréats de l’édition 2024 du concours, organisé en partenariat avec la @Fond_Michelin . pic.twitter.com/xnPwRSS2Lr

— La Sauvegarde (@LaSauvegarde) July 10, 2024